Deviation In Forex

27.09.2021Contents:

https://forexaggregator.com/ works best when used in concert with other tools. These include, but are not limited to, Fibonacci retracements, time price offering charts, and momentum oscillators. In contrast, low deviation shows that the prices are closely bunched together. Depending on the information in your hands, you have to decide where to invest. Low risk is good, but if the risk is too low, then the returns will not be huge, either. How we derive standard deviation depends on what we plan on using it for.

If https://forexarena.net/s are trading in a narrow trading range, the Standard Deviation indicator returns a low value, indicating low volatility. Conversely, if prices fluctuate sharply up and down, the Standard Deviation returns a high value, indicating high volatility. Standard Deviation measures market activity based on current volatility.

Standard Deviation — Why Its so Important for Forex Traders

When it comes to investing, there are many terms and concepts that can be difficult to understand. But what exactly does this term mean, and how does it impact your investments? Let’s take a closer look at what deviation in forex is and how it affects your investments. The indicator conditionally belongs to A trend is a direction in which the market or the price of an instrument is moving. Trends can be upward, downward or sideways and are common to all types of markets.

- Contracts for Difference are not available for US residents.

- For example, if the period is set at 20, the price arithmetic mean is calculated for the last 20 candlestick price bars.

- Here are two trading strategies which exemplify the use of StdDev.

- A standard deviation indicator maybe an easy tool in commerce nonetheless powerful enough to form or break your likelihood to win in an exceedingly bound trade.

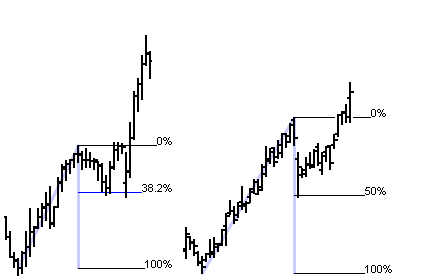

To do that, we need to scale down the chart as much as possible and draw a horizontal line through the levels at which the indicators were reversing most often. Then, reset the scaling and extend the levels’ lines as the price moves further. Here are two trading strategies which exemplify the use of StdDev.

Specifics of Standard Deviation Indicator:

Third, Standard Deviation is used to set an entry point based on outliers when prices point to a narrow trading range, and suddenly strong Standard Deviation pushes prices away from the mean. Indicator can be used as a trend filter in combination with oscillators − in case of breakdown of Standard Deviation line, a transaction is made in direction of trend. An example is the SD+RSI system, where trend indicator is StDev, and signal for transaction is RSI indicators in direction of Standard Deviation. Solve the problem of correct entry by building a moving average on Standard Deviation data. The SMA period is chosen in such a way that it becomes possible to smooth out random fluctuations. SMA(apPRICE, n, i) − any moving average of the current bar for n periods.

The standard deviation indicator itself is a quantitative measure of variability or deviation around the mean. When standard deviation gets higher, this means that variance/variability is increasing. When the standard deviation becomes lower, this means that the variance/variability decreases. Thus, the indicator is used to determine gravity or, in other words, the strength of an existing trend. The standard deviation could appear easy for non-traders, however truly, it’s a really helpful and necessary indicator in commerce.

About FXCM

Targeting entries within https://trading-market.org/s — if for example, prices spike away from the mean to far, they will fall back to the average eventually. If the trend is strong you can target entry at the mean price. Picking important market tops or bottoms i.e look for highly volatile prices that have spiked to far from the mean.

Since the reverse ascending movement isn’t as powerful as the previous descending one, the indicator goes down. The flat range starts when the indicator’s line is reversing. The flat areas are marked as red rectangles in the screen shot.

Below there’s a StdDev chart featuring various price types. There’s almost no difference in line drawing, except that the indicator built through Close prices is 1-2 candlesticks ahead of the others. Length, or the period, — the number of candlesticks that will be considered for calculation. A low standard deviation can indicate a flat area or a smooth ascending or descending trend.

Self-confessed Forex Geek spending my days researching and testing everything forex related. I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading!

RSI Indicator: How to Use, Best Settings, Buy and Sell Signals

In general, this indicator is used as a partial component with other indicators. For example, standard deviation can be used to determine the spread between the lower and upper Bollinger Bands. Standard Deviation doesn’t measure how far a data point is from the mean. Instead, it compares the square of the difference, the subtle but noticeable difference in the actual variance with the mean. In other words, Standard Deviation is a measure of volatility.

What is a Commodity Channel Index pattern? — IG

What is a Commodity Channel Index pattern?.

Posted: Tue, 07 Feb 2023 11:20:24 GMT [source]

Bollinger Bands are calculated using one standard SMA along with several other SMAs modified by adding or subtracting standard deviations. A very impressive and interesting website for forex traders and commodity market investors, i really impressed with all the content. I normally use 2 standard deviations, which enclose roughly 95% of the selected data. Using 3 standard deviations encloses about 99% of the selected data but the channel often appears too wide. Sydney Gas Limited is plotted with trend channels drawn at 2 standard deviations around a linear regression line.

Implied volatility in options trading explained — FOREX.com

Implied volatility in options trading explained.

Posted: Thu, 29 Sep 2022 07:00:00 GMT [source]

Conversely, a very low standard deviation indicates the opposite. It lets a trader know if volatility is likely to rise or fall based on its value. Daniels Trading is division of StoneX Financial Inc. located in the heart of Chicago’s financial district. Established by renowned commodity trader Andy Daniels in 1995, Daniels Trading was built on a culture of trust committed to a mission of Independence, Objectivity and Reliability.

Breakout trading plans also be suitable, although the risk of false breaks can limit performance. Learn everything you wanted to know about the stochastic oscillator and how to use it in trading. Stochastic is a technical indicator of the type of oscillator. Many professionals favor stochastic oscillators because of their signal accuracy and versatile applications. The first step is drawing support levels for both indicators.